Why Do Insurance Companies Need Lawyers? A Look at Their Legal Strategy

Understanding Why Do Insurance Companies Need Lawyers?

Why do insurance companies need lawyers? Because the insurance industry operates in a legal minefield. From negotiating claims to defending lawsuits, legal professionals are vital to managing liability, ensuring compliance, and minimizing financial losses. Whether it’s a simple fender bender or a multi-million-dollar injury claim, insurers rely on lawyers to protect their interests at every stage of the claims process.

How Lawyers Help Insurance Companies Defend Claims

When someone files a claim, especially in high-stakes situations like auto accidents or serious injuries, insurance companies must act quickly—and legally. Here’s how lawyers play a role.

Evaluating Legal Exposure

One of the first things an insurance company does after receiving a claim is assess its potential liability. Lawyers help evaluate the facts, review policy terms, and determine how much the company could owe if the case goes to trial. This risk assessment informs whether to settle or fight the claim.

Negotiating Settlements

Why do insurance companies need lawyers during settlement talks? Because negotiating a fair payout requires both legal insight and strategy. Lawyers help determine what a claim is truly worth based on:

- Medical expenses

- Property damage

- Lost wages

- Pain and suffering

- Policy limits and exclusions

Their goal is to settle cases fairly without overpaying or exposing the insurer to future lawsuits.

Handling Lawsuits

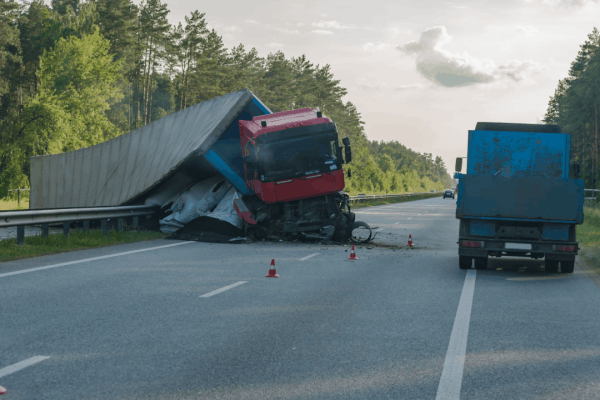

If a claim escalates to a lawsuit, the insurance company’s legal team takes over. Attorneys represent the insurer (and sometimes the insured) in court, draft legal documents, attend hearings, and present evidence. This is especially common in large commercial truck accident cases or complex liability disputes.

Why Legal Teams Are Built into Insurance Operations

Insurance companies don’t just hire lawyers when things go wrong. Most have in-house legal departments or partnerships with outside firms because legal issues arise frequently in their day-to-day operations.

Interpreting Policy Language

Insurance policies are legal contracts. Attorneys help draft and interpret the language in these documents to ensure they’re enforceable, clear, and aligned with state laws. This helps prevent disputes down the line.

Ensuring Regulatory Compliance

The insurance industry is heavily regulated. Companies must comply with state insurance laws, federal guidelines, and industry standards. Legal teams keep insurers informed and compliant, reducing the risk of fines or sanctions.

Preventing Fraud and Abuse

Lawyers assist in investigating suspicious claims and building legal cases against fraud. Their role is to protect the insurer from losses caused by false claims or unethical behavior—something that costs the industry billions each year.

The Legal Advantage in High-Risk Claims

Why do insurance companies need lawyers most urgently? When the stakes are high. Cases involving:

- Wrongful death

- Permanent disability

- Class action lawsuits

- Trucking and commercial vehicle collisions

- Bad faith accusations

All require advanced legal defense to avoid costly verdicts or settlements. Without legal representation, an insurance company could quickly lose in court or make an expensive mistake.

Why Legal Counsel Matters for Insurers

Why do insurance companies need lawyers? Because every claim carries legal risk. From interpretation of coverage to courtroom defense, lawyers help insurers make smart, lawful decisions. Their involvement helps control costs, avoid legal pitfalls, and maintain customer trust.

Get Help with Insurance Claim Disputes Today

If you’ve been in an accident and feel the insurance company isn’t treating you fairly, you don’t have to face them alone. Legal help levels the playing field. Get a free claim review to explore your rights and options.

For attorneys and law firms, partnering with Trucking Accident connects you with high-value clients in need of strong representation for claims involving commercial insurers.

Frequently Asked Questions (FAQs)

1. Why do insurance companies rely so heavily on lawyers?

Because legal issues arise frequently in claims, policy interpretation, and regulatory compliance.

2. Do insurance companies have their own lawyers?

Yes, many have in-house legal teams or retain outside counsel to handle various legal matters.

3. What kind of cases require insurance defense attorneys?

Personal injury claims, auto accidents, truck crashes, fraud investigations, and lawsuits all require legal representation.

4. Can an insurance company deny a claim without a lawyer?

Yes, but legal review helps ensure denials are valid, documented, and compliant with laws, reducing the risk of a bad faith lawsuit.

5. What’s the difference between in-house and outside counsel?

In-house lawyers are full-time employees of the insurance company; outside counsel are private law firms hired for specific cases.

Key Takeaways

- Insurance companies use lawyers to assess, defend, and resolve claims legally.

- Legal teams help negotiate settlements and avoid unnecessary payouts.

- Attorneys ensure policies comply with state laws and industry regulations.

- High-risk claims require experienced legal defense to prevent major losses.

- Legal professionals are essential to protecting the insurer and its insured parties.