Can a Lawyer Negotiate with Insurance Adjusters?

Legal Authority Explained: Can a Lawyer Negotiate with Insurance Adjusters

Can a lawyer negotiate with insurance adjusters? The answer is yes. Lawyers possess legal authority to negotiate directly with insurance companies on behalf of their clients. Lawyers can represent clients in negotiations with insurance companies.

Insurance adjusters work for insurance companies with the primary goal of minimizing payouts. When you hire a lawyer, you level the playing field by having an advocate who understands insurance law, knows negotiation tactics, and can effectively counter lowball settlement offers.

Professional Advantages Outlined: Why Lawyers Excel at Insurance Negotiations

Lawyers bring several critical advantages to insurance negotiations that individual claimants simply cannot match. Legal professionals understand the intricate details of insurance policies, state regulations, and federal guidelines that govern insurance practices.

Lawyers may help calculate compensation considerations, including medical expenses, lost wages, pain and suffering, and future damages.

Professional negotiators also understand the psychological aspects of settlement discussions. They know when to push for higher amounts, when to threaten litigation, and how to present evidence in the most compelling manner. This expertise proves invaluable when insurance adjusters attempt to minimize claim values through various tactics.

Legal Knowledge and Experience

Experienced attorneys understand insurance law complexities that most people never encounter. They know which documents to request, how to interpret policy language, and what constitutes bad faith insurance practices. This knowledge allows them to identify when insurance companies are acting inappropriately or offering unreasonably low settlements.

Evidence Presentation Skills

Lawyers excel at organizing and presenting evidence in ways that may improve claim presentation. They know how to document injuries, gather expert testimony, and compile medical records that support higher settlement amounts. This professional presentation often convinces adjusters to offer more reasonable compensation packages.

Settlement Success Factors: How Lawyer Representation Changes Outcomes

Lawyers also expedite the settlement process by handling all communications with insurance companies. This professional buffer prevents adjusters from using high-pressure tactics or taking advantage of inexperienced claimants. Legal representation signals to insurance companies that claims will be thoroughly evaluated and aggressively pursued if necessary.

Lawyers can communicate with insurance companies on behalf of clients and handle claim-related negotiations.

Strategic Negotiation Approach

Professional attorneys develop comprehensive negotiation strategies based on case specifics, insurance company practices, and applicable laws. They understand when to accept offers, when to counteroffer, and when to threaten litigation to achieve optimal results.

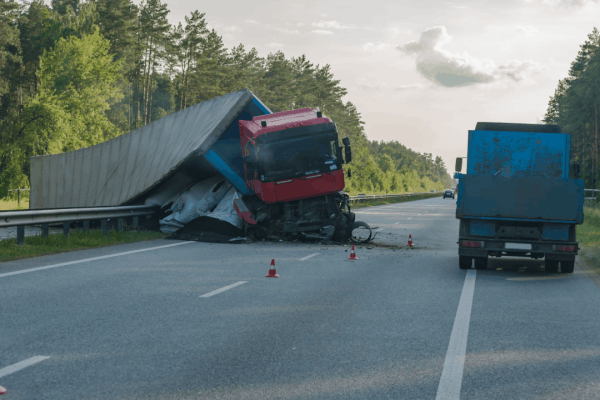

At truckingaccident.com/, experienced legal professionals provide legal information about complex insurance negotiations. These cases often involve multiple insurance companies, complex liability issues, and substantial compensation claims.

Important Legal Considerations: Can a Lawyer Negotiate with Insurance Adjusters Effectively

Several factors influence how effectively lawyers can negotiate with insurance adjusters. State insurance regulations vary significantly, and some states provide stronger consumer protections than others. The Department of Insurance in each state oversees insurance company practices and provides resources for consumers experiencing difficulties with claims.

Timing also plays a crucial role in successful negotiations. Lawyers understand statute of limitations requirements, documentation deadlines, and optimal timing for settlement discussions. They also know when insurance companies are most likely to negotiate seriously versus when they might delay tactics.

Professional relationships between lawyers and insurance companies can facilitate more productive negotiations. Experienced attorneys often have established relationships with adjusters and understand their decision-making processes, leading to more efficient resolution of claims.

Final Settlement Strategy: Can a Lawyer Negotiate with Insurance Adjusters Successfully

Can a lawyer negotiate with insurance adjusters? Yes. Lawyers can represent clients in insurance negotiations. Lawyers bring legal expertise, negotiation skills, and industry knowledge that individual claimants cannot match.

Most personal injury lawyers explain contingency fee arrangements that are generally outcome-dependent. This arrangement makes professional legal representation accessible to anyone dealing with insurance claim disputes.

Take Action Now: Can a Lawyer Negotiate with Insurance Adjusters for You

Contact experienced legal professionals at trucking accident for a free consultation and learn about legal options and information regarding compensation, depending on the circumstances.

Frequently Asked Questions

1. Can a lawyer negotiate with insurance adjusters immediately after an accident?

Yes, lawyers can begin negotiations immediately after being retained. Early legal involvement often prevents insurance companies from using delay tactics or pressuring claimants into quick, inadequate settlements.

2. How much more compensation do people receive when lawyers negotiate with insurance adjusters?

Studies show that represented claimants typically receive 300-400% more compensation than those who negotiate independently. The exact increase depends on case complexity and claim value.

3. Can a lawyer negotiate with insurance adjusters if I already started talking to them?

Absolutely. Lawyers can take over negotiations at any point during the claims process. However, earlier involvement typically produces better results and prevents potential mistakes.

4. What prevents insurance adjusters from refusing to negotiate with lawyers?

Insurance adjusters are legally required to negotiate in good faith with authorized representatives. Refusing to work with lawyers could constitute bad faith insurance practices, which carry significant legal consequences.

5. Can a lawyer negotiate with insurance adjusters for any type of claim?

Yes, lawyers can negotiate for various claim types including auto accidents, property damage, personal injury, workers’ compensation, and disability claims. Different practice areas require specialized knowledge and experience.

Key Takeaways

- Lawyers possess legal authority to negotiate directly with insurance adjusters on behalf of clients

- Professional representation typically results in 300-400% higher settlement amounts than independent negotiations

- Legal expertise in insurance law, policy interpretation, and negotiation tactics provides significant advantages

- Lawyers understand timing, documentation requirements, and strategic approaches that maximize claim values

- Contingency fee arrangements make professional legal representation accessible without upfront costs