Accident Liability Explained: Who’s at Fault and How It’s Decided

How is Liability Determined in an Accident? Understanding the Process

How is liability determined in an accident depends on several key factors that insurance companies and legal professionals carefully examine. When accidents occur, determining who bears responsibility involves analyzing evidence, witness statements, and applicable laws.

The liability determination process affects insurance premiums, legal outcomes, and financial responsibility for damages. Whether you’re involved in a car accident, workplace incident, or property damage case, knowing how fault gets assigned can significantly impact your situation.

Evidence Collection: The Foundation of Liability Determination

Insurance adjusters and legal professionals rely heavily on physical evidence when determining liability in accidents. Police reports serve as primary documentation, containing officer observations, traffic citations, and initial fault assessments.

Witness statements carry significant weight in liability determinations. Independent witnesses offer unbiased perspectives that help reconstruct accident sequences.Medical records document injury patterns that can indicate impact directions and collision severity. Property damage assessments reveal collision forces and contact points that support or contradict driver statements about accident circumstances.

Legal Factors That Influence How Liability is Determined in an Accident

Traffic laws and regulations form the backbone of accident liability determination. Drivers who violate traffic rules typically bear primary responsibility for resulting accidents. Common violations include speeding, running red lights, failing to yield, and following too closely.

Comparative negligence laws vary by state and significantly affect liability outcomes. Some states follow pure comparative negligence, where damages are reduced by each party’s percentage of fault. Other states use modified comparative negligence, barring recovery if a party is more than 50% at fault.

Insurance Company Investigation Process

Insurance companies conduct thorough investigations to determine liability in accidents. Adjusters interview all involved parties, review police reports, and examine physical evidence. They often reconstruct accident scenes using specialist software and expert analysis.

Each insurance company advocates for their policyholder while negotiating with other insurers. When liability is disputed, companies may hire accident reconstruction experts or attorneys to support their position. The investigation process typically takes several weeks to months, depending on accident complexity.Settlement negotiations begin once initial liability assessments are complete.

Protecting Yourself During Liability Determination

Document everything immediately after accidents occur. Take photographs of all vehicles, property damage, and accident scenes from multiple angles. Collect contact information from witnesses and other involved parties.

Consider consulting with personal injury attorneys when significant damages or injuries are involved. Legal representation can protect your interests during complex liability determinations, especially when multiple parties share responsibility.

When Liability Determination Becomes Complex

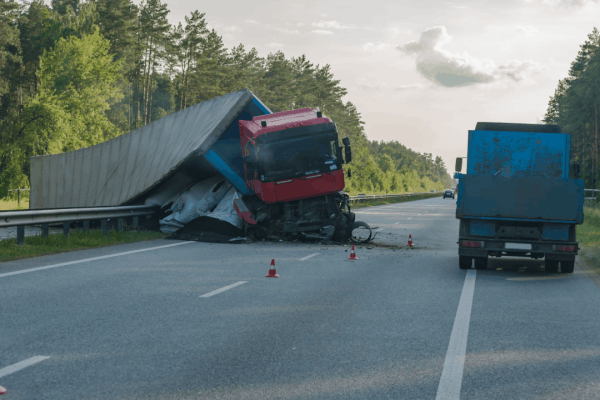

Multi-vehicle accidents often involve complex liability assessments where several parties may share fault. Chain-reaction collisions require careful analysis to determine which actions triggered the accident sequence and which parties bear primary responsibility.

Commercial vehicle accidents introduce additional liability considerations, including employer responsibility, vehicle maintenance records, and driver qualification requirements. The Federal Motor Carrier Safety Administration (FMCSA) maintains extensive databases of commercial driver violations and company safety records that influence liability determinations.

Defective vehicle parts or road conditions can shift liability away from drivers to manufacturers or government entities. The National Highway Traffic Safety Administration (NHTSA) investigates vehicle defects and maintains recall databases that can establish manufacturer liability. State Department of Transportation (DOT) agencies bear responsibility for road maintenance and design defects that contribute to accidents.

Understanding Your Rights: How Liability Determination Affects You

Liability determination directly impacts your financial responsibility for accident damages. Understanding how fault affects your insurance rates, legal exposure, and recovery options helps you make informed decisions throughout the claims process.

If you disagree with liability determinations, you have options for challenging those decisions. Insurance companies have internal appeal processes, and you can pursue arbitration or litigation when necessary to protect your interests.

Contact a Legal Professional Today

Don’t navigate complex liability determinations alone. Experienced personal injury attorneys understand how liability is determined in an accident and can protect your rights throughout the process. Visit trucking accident today to learn more about your legal options and connect with qualified attorneys who specialize in accident cases.

Frequently Asked Questions

1. How long does liability determination take after an accident?

Liability determination typically takes 2-8 weeks for straightforward cases, but complex accidents involving multiple parties or disputed facts may take several months to resolve completely.

2. Can liability determination change after initial assessment?

Yes, new evidence such as additional witness statements, expert analysis, or medical records can cause insurance companies to modify their initial liability assessments.

3. What happens when both drivers are equally at fault?

In comparative negligence states, each driver typically bears 50% responsibility for damages. Both parties may recover reduced compensation based on their fault percentage.

4. Do police reports determine final liability?

Police reports influence liability decisions but don’t determine final fault assignments. Insurance companies and courts can reach different conclusions based on additional evidence and legal analysis.

5. How does weather affect liability determination in accidents?

Weather conditions are considered environmental factors that may reduce driver fault percentages. However, drivers must still exercise reasonable care for conditions, and weather rarely eliminates liability entirely.

Key Takeaways

- Liability determination relies on evidence including police reports, witness statements, photographs, and physical damage assessments

- Traffic law violations typically establish primary fault, but comparative negligence laws affect final responsibility percentages

- Insurance companies conduct independent investigations and may disagree on fault assignments, leading to negotiations or legal proceedings

- Protecting yourself requires immediate documentation, avoiding fault admissions, and potentially seeking legal representation for complex cases

- Understanding the liability determination process helps drivers make informed decisions about insurance claims and legal strategies