What is a Reasonable Settlement Offer | A Complete Legal Guide

What is a Reasonable Settlement Offer

What is a reasonable settlement offer? A reasonable settlement offer generally reflects a substantial portion of documented damages when liability is clear, including medical expenses, lost wages, pain and suffering, and future costs. The exact amount depends on injury severity, case strength, and available insurance coverage.

Understanding what constitutes a fair settlement offer can mean the difference between adequate compensation and financial hardship. Most personal injury cases settle out of court, making it crucial to recognize when an offer meets your needs. This guide explains how to evaluate settlement offers and determine what amount truly reflects your case’s value.

Damage Calculation: How Settlement Amounts Are Determined

Settlement offers are calculated using both economic and non-economic damages. Economic damages include medical bills, lost income, property damage, and future medical costs. Non-economic damages cover pain and suffering, emotional distress, and loss of enjoyment of life.

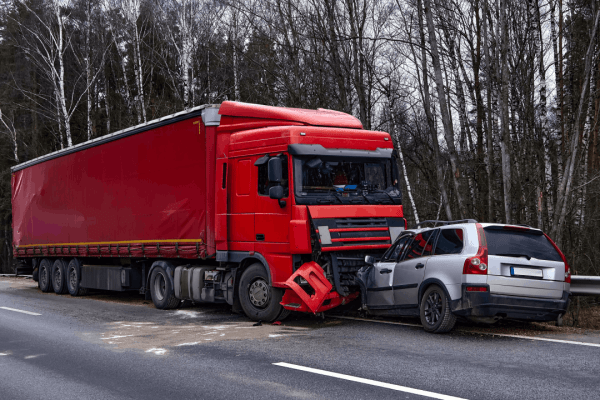

Insurance companies may use internal valuation methods, which can include consideration of medical expenses and injury severity, when evaluating pain and suffering. Severe injuries with permanent effects warrant higher multipliers. For trucking accidents, settlements may involve higher evaluations due to commercial insurance policies and the nature of the injuries involved.

Factors That Influence Offer Amounts

Several key factors determine what is a reasonable settlement offer:

- Liability strength: Clear fault increases settlement value

- Injury severity: Permanent disabilities command higher compensation

- Insurance limits: Available coverage caps potential offers

- Legal representation: Attorneys can influence claim evaluation and negotiation strategy

- Documentation quality: Strong evidence supports higher valuations

Government Standards: Official Guidelines for Fair Compensation

The Social Security Administration provides disability evaluation criteria that inform settlement calculations for permanent impairments. Their guidelines help establish baseline compensation for lost earning capacity.

The Bureau of Labor Statistics inflation calculator ensures settlements account for future cost increases. The National Highway Traffic Safety Administration crash data helps attorneys benchmark similar case outcomes nationwide.

Red Flags: When Settlement Offers Fall Short

Low-ball offers are common tactics used by insurance companies. Offers that fail to account for documented damages or unresolved medical issues may warrant closer review. Quick settlement offers immediately after accidents often fail to account for developing injuries or long-term complications.

Be wary of offers that don’t cover all medical expenses or ignore lost future earnings. Settlement negotiations require patience and thorough damage assessment before accepting any amount.

Final Verdict: Maximizing Your Settlement Value

What is a reasonable settlement offer ultimately depends on your specific circumstances, but should comprehensively address all damages while considering case strengths and weaknesses. Professional legal evaluation assist in evaluating whether a proposed settlement adequately addresses documented damages.

Take Action Now: Get Your Case Evaluated

Don’t accept the first offer without professional guidance. Experienced attorneys can provide information about settlement evaluation and negotiation processes. Contact us today, free case evaluations are available to discuss settlement evaluation considerations for your specific situation.

Frequently Asked Questions

1. What percentage of total damages is reasonable for settlement?

A reasonable settlement typically ranges from 75-100% of total calculated damages when liability is clear. Weaker cases may settle for 50-75% of damages.

2. How long do I have to accept a settlement offer?

Most settlement offers remain open for 30 days, though this varies. You have no legal obligation to accept immediately and can negotiate or reject offers.

3. Should I accept the first settlement offer?

Rarely. First offers typically represent 10-25% of a case’s true value. Insurance companies expect negotiation and often have authorization to pay significantly more.

4. What if the settlement offer doesn't cover all my medical bills?

Any reasonable settlement should cover current and future medical expenses. If an offer falls short of medical costs alone, it’s likely inadequate compensation.

5. Can I negotiate a settlement offer myself?

While legally possible, self-representation typically results in settlements 3-4 times lower than attorney-negotiated amounts. Insurance companies take advantage of unrepresented claimants.

Key Takeaways

- A reasonable settlement offer covers 75-100% of total damages when liability is clear

- Economic damages include medical bills, lost wages, and property damage

- Non-economic damages use multipliers of 1.5-5x medical expenses for pain and suffering

- Government resources provide standards for disability evaluation and cost calculations

- Professional legal representation typically increases settlement values by 300-400%