What is the Insurance for Truck Drivers Injury? Your Complete Coverage Guide

Understanding Coverage: What is the Insurance for Truck Drivers Injury

What is the insurance for truck drivers injury? Truck driver injury insurance typically includes workers’ compensation, occupational accident insurance, and liability coverage that protects drivers when they’re hurt while working. These insurance types may help cover medical expenses, lost wages, and rehabilitation costs when truckers face workplace injuries.

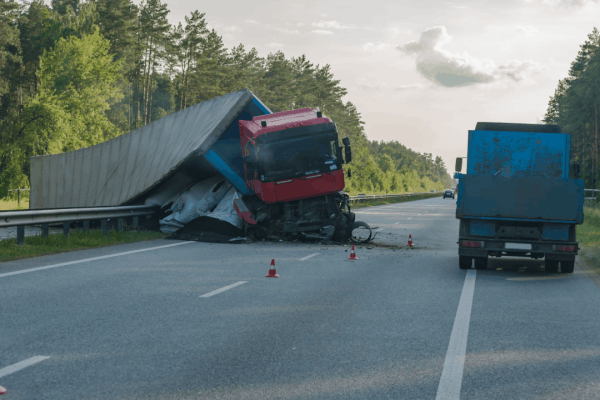

Professional truck drivers face unique risks daily, from loading accidents to highway collisions. Understanding your injury insurance options helps protect your livelihood and ensures proper medical care when accidents occur. This guide explains the essential coverage types, requirements, and how to access benefits when you need them most.

Coverage Types: What is the Insurance for Truck Drivers Injury Options

Workers’ Compensation: Insurance Most company drivers receive workers’ compensation coverage through their employers. This insurance covers medical expenses, partial wage replacement, and disability benefits for work-related injuries. The Federal Motor Carrier Safety Administration (FMCSA) requires motor carriers to maintain adequate insurance coverage for their drivers.

Occupational Accident Insurance: Independent contractors and owner-operators often purchase occupational accident insurance since they’re typically excluded from workers’ compensation. This coverage provides similar benefits including medical payments, disability income, and accidental death benefits. Many trucking companies offer group occupational accident policies for their contract drivers.

Personal Injury Protection (PIP): Some states require PIP coverage, which pays medical expenses and lost wages regardless of fault in vehicle accidents. This coverage works alongside other insurance types to ensure comprehensive protection for truck drivers injured in crashes.

Legal Requirements: What is the Insurance for Truck Drivers Injury Mandates

The Department of Transportation (DOT) establishes minimum insurance requirements for commercial motor carriers. Interstate trucking companies must carry at least $750,000 in liability insurance, though this primarily covers damage to others rather than driver injuries.

State laws vary significantly regarding injury coverage requirements. Company employees typically receive workers’ compensation automatically, while independent contractors must secure their own coverage. The Occupational Safety and Health Administration (OSHA) also sets workplace safety standards that impact injury prevention and coverage requirements.

Understanding these legal requirements helps drivers ensure they have adequate protection. Trucking accident attorneys often assist drivers in navigating complex insurance requirements and determining appropriate coverage levels for their specific situations.

Common Coverage Gaps

Many truck drivers unknowingly have coverage gaps that could leave them financially vulnerable. Independent contractors may assume they’re covered under the carrier’s policy, while company drivers might not understand their workers’ compensation limitations. These gaps can result in denied claims and significant out-of-pocket expenses.

Filing Claims Process

When injuries occur, prompt reporting is crucial for successful claims processing. Most insurance policies require immediate notification of accidents and injuries. Documentation including medical records, incident reports, and witness statements can help support a claim and improve the likelihood of coverage approval.

Bottom Line: What is the Insurance for Truck Drivers Injury Protection

What is the insurance for truck drivers injury ultimately depends on your employment status and state requirements. Company drivers typically rely on workers’ compensation, while independent contractors need occupational accident insurance. Understanding your coverage can help reduce financial hardship when workplace injuries occur and may support access to medical care and wage replacement during recovery.

Get Help: What is the Insurance for Truck Drivers Injury Claims

Injured truck drivers often face complex insurance challenges that require professional guidance. Insurance companies may deny valid claims or offer inadequate settlements that don’t cover your full losses. Don’t navigate these challenges alone when your livelihood depends on proper coverage and fair compensation.

Contact experienced trucking accident lawyers who understand the unique insurance issues facing truck drivers. Professional legal assistance can help you understand available benefits and protect your rights throughout the claims process.

Frequently Asked Questions

1. What insurance covers truck drivers who get hurt at work?

Workers’ compensation covers company employees, while independent contractors typically need occupational accident insurance for work-related injuries.

2. Do owner-operators need special injury insurance?

Yes, owner-operators usually aren’t covered by workers’ compensation and should purchase occupational accident insurance or similar coverage.

3. How much does truck driver injury insurance cost?

Costs vary by coverage type, driving record, and risk factors, typically ranging from $500 to $2,000 annually for occupational accident insurance.

4. What injuries does truck driver insurance typically cover?

Most policies cover medical expenses, lost wages, and disability benefits for injuries like back strains, slip-and-falls, and crash-related trauma.

5. Can truck drivers get both workers' comp and other injury insurance?

Company drivers receive workers’ compensation, but additional coverage like personal injury protection may apply depending on state laws and circumstances.

Key Takeaways

- Workers’ compensation covers company truck drivers for work-related injuries including medical expenses and wage replacement

- Occupational accident insurance provides similar protection for independent contractors and owner-operators excluded from workers’ comp

- Legal requirements vary by state and employment status, with DOT setting minimum carrier insurance standards

- Coverage gaps commonly occur when drivers misunderstand their employment classification or assume inadequate protection

- Professional legal help ensures proper claims handling and maximum benefit recovery when insurance disputes arise